(Reuters) - Portugal's EDP Renovaveis will offer 90 new wind turbines at auction after pulling out of major Colombia wind energy projects, the website of industrial equipment auctioneer Escrapalia showed on Tuesday. The Vestas V162-5.6 MW turbines will be sold in an online auction, Escrapalia said. EDPR, the world's fourth-largest wind power producer, posted an unexpected net... Continue Reading →

Geopark announces the sale of its 10% stake in Manati Field

(PN) GeoPark announced a reorganization of its portfolio, with repercussions on its operations in Brazil. The company revealed that it will sell certain “non-core” assets, as well as implement cost reduction initiatives to strengthen its position aiming at profitable, reliable and sustainable growth in the long term. One of the points of the reorganization involves... Continue Reading →

Sempra to sell Mexico energy assets, stake in infrastructure unit

(Reuters) - Utility firm Sempra will sell some energy infrastructure assets in Mexico and a minority stake in Sempra Infrastructure to fund its five-year capex plan of $56 billion, it said on Monday. In February, the company had forecast a five-year capital plan of about $56 billion, a 16% increase from its prior plan, with over... Continue Reading →

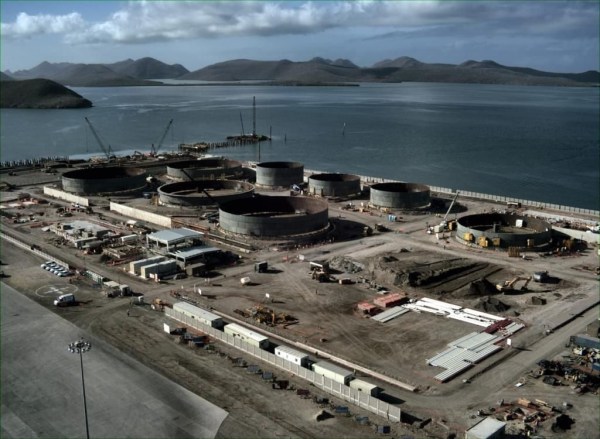

Woodside to Shed some Trinidad and Tobago Assets for $206M

(Reuters) Australia's Woodside Energy said on Friday it would sell some assets in its offshore oil and gas project in Trinidad and Tobago to London-based Perenco for $206 million. The sale includes the Greater Angostura project's offshore production facilities and interests in the shallow water Angostura and Ruby fields, but excludes assets in the deepwater... Continue Reading →

Argentina YPF to get rid of offshore exploration projects, CEO says

(Reuters) - Argentina's energy company YPF wants to speed up a divestiture plan that includes selling controlling stakes in offshore exploration projects in Argentina and Uruguay, reducing its presence in mature fields and later offering a gas distribution company for sale, chief executive officer Horacio Marin said. YPF has exploration rights in seven offshore areas,... Continue Reading →

Iberdrola seeks partner for 1 GW renewables portfolio, sources say

(Reuters) - Spanish energy company Iberdrola is seeking a partner willing to buy a minority stake in a roughly 1 gigawatt renewables portfolio, according to two people familiar with the matter. The sources described the project as "Romeo 2.0," referring to a 1.3 GW portfolio of wind and solar assets in which Norway's sovereign wealth... Continue Reading →

Petrobras announces termination of divestment process of assets in Colombia

Petrobras, following up on the release disclosed on June 12, 2020, announces that its Executive Board has approved today the termination of the divestment project related to the sale of 100% of the shares held by Petrobras International Braspetro B.V. (PIB BV) and other Petrobras subsidiaries, in Petrobras Colombia Combustibles (PECOCO). The decision is in... Continue Reading →

Brava -Definition of Perimeter for Binding Phase of Possible Sale of Onshore and Shallow Water Assets

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3:BRAV3), pursuant to CVM Resolution No. 44, following the material facts disclosed on December 27, 2024 and on January 10 and 24, 2025, informs its investors and the market in general that the Company's Board of Directors has defined that the scope of the possible divestment transaction of the... Continue Reading →

Seacrest Petróleo files for bankruptcy protection after collection proceedings from Petrobras and former financial advisor

(Valor Feb. 20, 2025) With a debt of R$3.3 billion, Seacrest Petróleo filed for bankruptcy protection in the Court of Justice of São Paulo. The company is seeking to suspend collection proceedings and early maturity of the debt for a period of 180 days. The decision to file came after the company received requests for... Continue Reading →

Prosafe Sells Safe Concordia Flotel

(OE) Offshore accommodation rig provider Prosafe has signed an agreement with an undisclosed party for the sale of its Safe Concordia semi-submersible flotel. Prosafe signed the deal through its wholly-owned subsidiary for the gross price of $5 million before commissions and expenses. The vessel is expected to be delivered to its new owner upon completion... Continue Reading →