(Reuters) U.S. utility firm Dominion Energy said on Thursday it would sell a 50% non-controlling interest in its Coastal Virginia offshore wind farm to Stonepeak to help fund construction of the roughly $10 billion project. Dominion said it would retain full control of the construction and operation of the project, with Stonepeak to pay for... Continue Reading →

Brazil’s Petrobras seeks to settle refinery deal structure with Mubadala by end-June

(Reuters) - Brazilian state-run oil company Petrobras (PETR4.SA), opens new tab hopes to settle details of a tie-up with Mubadala to take back control of the operation of a refinery owned by the Abu Dhabi sovereign investor by the end of the first half of the year, Petrobras' chief executive said on Tuesday. CEO Jean Paul Prates... Continue Reading →

EXCLUSIVE: 3R shareholder proposes merger of assets with PetroReconcavo

(BJ) A relevant shareholder of 3R Petroleum is proposing a carveout of the company's onshore oil fields and the incorporation of these assets by PetroReconcavo, in a transaction that shows the struggle of junior oils for scale, sources familiar with the matter told Brazil Journal. The rationale for the transaction is already known to the... Continue Reading →

Brazil’s Petrobras plans to finish RNEST refinery’s Train 1 expansion in early 2025

(Reuters) - Brazilian state-run oil firm Petrobras (PETR4.SA), opens new tab said on Wednesday that it plans to finish expansion works on Train One of its Abreu e Lima (RNEST) refinery in the first quarter of 2025, nearly a decade after the expansion was halted due to a massive corruption scandal. Work at the second train of... Continue Reading →

Shell to exit Nigeria’s troubled onshore oil after nearly a century

(Reuters) - Shell (SHEL.L) is set to conclude nearly a century of operations in Nigerian onshore oil and gas after agreeing to sell its subsidiary there to a consortium of five mostly local companies for up to $2.4 billion.The British energy giant pioneered Nigeria's oil and gas business beginning in the 1930s. It has struggled for years... Continue Reading →

Petrobras informs receipt of contractual installment for Carmópolis Cluster

January 10, 2024 – Petróleo Brasileiro S.A. – Petrobras, in continuity with the announcement made on December 26, 2023, informs that it received, on today's date, from Carmo Energy, the last installment in the amount of US$ 298 million, already considering the adjustments and late payment charges due, related to the sale of the Carmópolis... Continue Reading →

Exxon faces hurdles in $2.5 billion exit from California offshore

(Reuters) - Exxon Mobil's write-down of about $2.5 billion of troubled California properties aims to end five decades of offshore oil production in the state, but a full exit from those assets could take some time. Sable Offshore, a company created in 2020, agreed more than a year ago to pay $643 million for Exxon's... Continue Reading →

Engie Brasil sells 15% stake in gas pipeline firm TAG to Canada’s CDPQ

(Reuters) - Engie Brasil (EGIE3.SA) said on Thursday it had reached a deal to sell a 15% stake in natural gas pipeline firm TAG to Canadian investment fund Caisse de Depot et Placement du Quebec (CDPQ) for 3.1 billion reais ($641 million). CDPQ, Canada's No.2 pension fund manager with C$424 billion ($320.60 billion) under management, will raise... Continue Reading →

Petrobras Faces Roadblock in Carmopolis Assets Sale

(Z) Petrobras, Brazil's national oil company, encountered a significant roadblock in the ongoing sale of onshore Carmópolis to Carmo Energy. The sale of Petrobras' onshore assets was likely driven by strategic business decisions. This divestiture aligns with the company’s broader strategy, which may involve focusing on core activities, reducing debt or generating funds for new... Continue Reading →

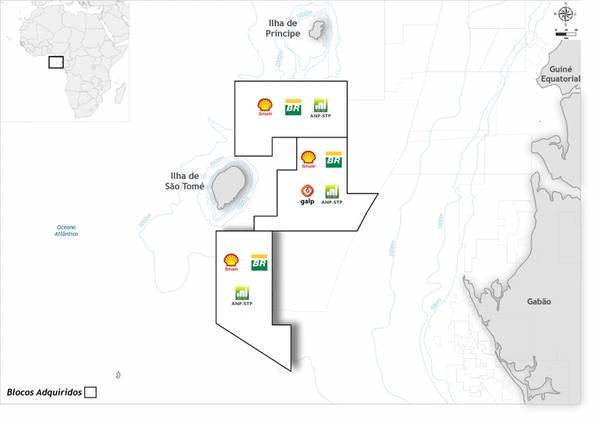

Petrobras on exploratory blocks in São Tomé and Príncipe

Petróleo Brasileiro S.A. – Petrobras informs that the Board of Directors has approved the company's operations in São Tomé and Príncipe, a country on the west coast of Africa, enabling the acquisition of stakes in 3 exploratory blocks, through a competitive process conducted by Shell. The transaction is part of the scope of the Memorandum... Continue Reading →