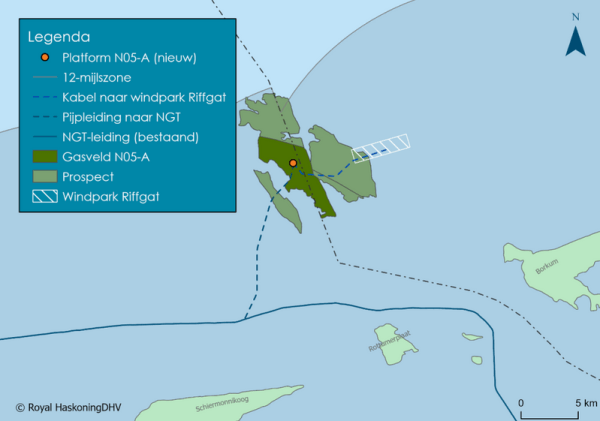

(OE) The N05-A platform is the first offshore gas platform in the Dutch North Sea to be powered entirely by wind power – harnessing electricity via cable from the nearby 113.4 MW Riffgat offshore wind farm. The platform is part of the GEMS (‘Gateway to the Ems’) project, which focuses on developing field N05-A and other fields in the... Continue Reading →

Petrobras informs about operations with Banco do Brasil

Petróleo Brasileiro S.A. – Petrobras informs that it has signed the following agreements with Banco do Brasil (BB): (i) The contracting of two Export Credit Notes (ECN) with sustainability commitments, one valued at R$ 3.5 billion and the other at R$ 3 billion, both maturing in 2032; (ii) Renewal of a Revolving Credit Facility (RCF)... Continue Reading →

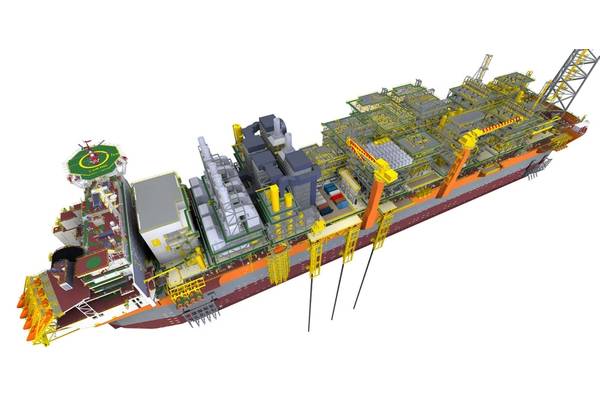

Agogo FPSO Set to Sail to Azule Energy’s Field Offshore Angola

(OE) The Agogo floating, production, storage and offloading (FPSO) unit is ready to set sail from Chinese shipyard to Azule Energy’s development offshore Angola. Yinson Production has officially named the Agogo FPSO at a grand naming and sail away ceremony held at Cosco Shipping Heavy Industry (Shanghai) shipyard in Shanghai, China. The vessel is now... Continue Reading →

China’s clean energy investments nearing scale of global fossil investments, researchers find

(Reuters) - China invested 6.8 trillion yuan ($940 billion) in clean energy in 2024, approaching the $1.12 trillion in global investment in fossil fuels, opens new tab, according to a new analysis for U.K.-based research organisation Carbon Brief. That was despite growth in China's clean energy investments slowing to 7% from 40% in 2023 amid overcapacity.... Continue Reading →

Yinson Widens CCS Portfolio with Stella Maris Acquisition

(OE) Yinson Production has completed the acquisition of Norway-based carbon capture and storage (CCS) company Stella Maris CCS from Altera Infrastructure. Stella Maris is developing a full CCS value chain, including carbon capture, intermediate storage, offshore transportation, and permanent sequestration of CO2 captured from industrial sources. The company holds a 40% stake in the Havstjerne... Continue Reading →

SBM Offshore, Petrobras to Assess Application of Carbon Capture Tech on FPSOs

(OE) SBM Offshore and Petrobras have signed an agreement to study the application of carbon capture modules on floating production, storage, and offloading (FPSO) units. The module design is based on an engineering and design study between SBM Offshore and Mitsubishi Heavy Industries (MHI), qualified by DNV. It is based on a combination of MHI’s... Continue Reading →

FPSO Almirante Tamandaré Begins Production in the Pre-Salt

Petróleo Brasileiro S.A. – Petrobras informs that the FPSO Almirante Tamandaré (Búzios 7) has started production today in the Búzios field, located in the pre- salt layer of the Santos Basin. This is the first high-capacity unit to be installed in the field, with the potential to produce up to 225,000 barrels of oil per... Continue Reading →

UK Opens Incentive Scheme for Offshore Wind Farms

(Reuters) Britain opened an incentive scheme on Thursday for offshore wind projects, seeking to persuade developers to provide the investment to meet an ambitious goal of decarbonising the country's energy system by 2030. The scheme, called the 'Clean Industry Bonus', will provide successful bidders with an initial 27 million pounds ($33.5 million) in funding for... Continue Reading →

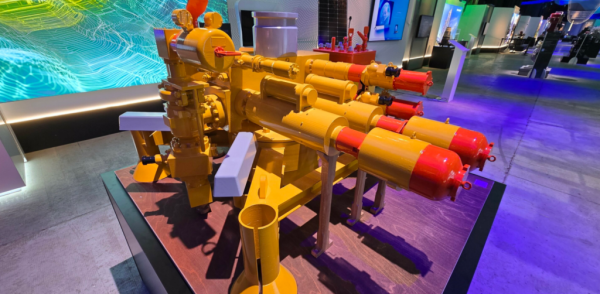

Baker Hughes rolls out all-electric subsea system to advance offshore electrification

(offshore-energy.biz) U.S.-headquartered energy technology giant Baker Hughes has launched an all-electric subsea production system, marking a step towards full electrification in offshore operations. According to Baker Hughes, the system delivers a fully electric topside-to-downhole solution, designed to integrate with existing subsea tree designs or retrofit electro-hydraulic trees. The move aims to slash costs, installation time,... Continue Reading →

Mitsubishi Reassessing Japan Offshore Wind Projects Amid Market Changes

(Reuters) Mitsubishi Corp on Monday said it is reviewing how to proceed with its offshore wind projects in Japan given a "significantly changed" business environment, showing that the country is not immune to rising costs across offshore wind projects globally. Japan, which imports nearly everything for its energy needs, has bet on renewable energy to... Continue Reading →