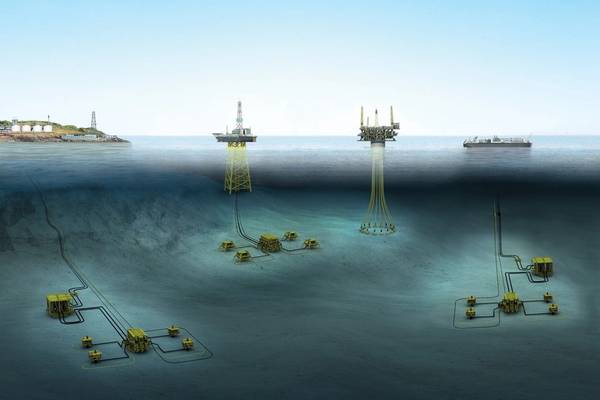

Wendy Laursen, Contributing Writer (OE) The more production infrastructure we push to the seabed, the more data we need to pull back up. With it comes opportunity. Chevron’s landmark 6,500 tons of subsea gas compression infrastructure for Jansz-Io demonstrates the scale of what is being put on the seabed, but there’s a diversity of other infrastructure under... Continue Reading →

Brazil’s Petrobras to reduce investments planned for 2025, sources say

(Reuters) - Brazil's Petrobras is set to reduce planned investments for next year, despite requests by the government for the state-run oil firm to increase CAPEX, three sources close to the matter told Reuters. The firm foresaw $21 billion of investments for next year, but spending could be down to around $17 billion, according to initial... Continue Reading →

Q Vision Near-Term Viable Market data module

There’s a new realism in the Floating Wind Industry. The big numbers from the hype days were never going to make it in time and projects are ‘moving to the right’ we hear almost daily. But perhaps those projects had too optimistic timelines initially. In reality, 2030 was just a round number and now that it’s suddenly close... Continue Reading →

Petrobras revises CAPEX projection for 2024

Petrobras, pursuant to CVM Resolution No. 44/21, informs that its total CAPEX projection for 2024 has been revised to a range of investments between US$ 13.5 billion and US$ 14.5 billion, considering mainly a new CAPEX for the E&P segment of US$ 11.1 billion to US$ 12.1 billion for this year. This level of investment... Continue Reading →

How to choose the right hose for your FPSO operations

(Raphaël Poquet, Trelleborg Oil & Marine product manager) With a surge in the need for energy to meet global demand, the order book for Floating Production Storage and Offloading (FPSO) vessels is climbing. This trend can be seen in the global expansion of new, often remote, and challenging regions. As a result, the need for... Continue Reading →

Ørsted Assumes Full Ownership of Sunrise Wind Offshore Wind Farm

(OE) Ørsted has completed the acquisition of Eversource’s 50 % share of Sunrise Wind, a 924 MW offshore wind farm located off the coast of New York. The purchase price at closing to acquire Eversource’s share of Sunrise Wind is $152 million. At signing in January 2024, the transaction was valued at $230 million, and... Continue Reading →

Prysmian re-jigs Latam management, eyes offshore wind farm demand in Brazil

(Reuters) - Italian cablemaker Prysmian (PRY.MI), opens new tab has shifted around management in Brazil and Latin America as it gears up local plants to boost supply to the electricity sector and future offshore wind farms in the region, the company told Reuters. Raul Gil Boronat, who led Prysmian in Brazil, took over as CEO for Latin... Continue Reading →

Halliburton Landmark supporting Mero Field digital twin development

(OM) Late last month Halliburton Landmark announced it is working with the Petrobras-led Libra Consortium on a digital twin for the presalt Mero Field in the Santos Basin offshore Brazil. The aim is to help reduce capex, speed up production times and improve crude oil recovery using the new insights obtained in a real-time environment. The digital twin, a... Continue Reading →

Navitas assessing FPSOs for Phase 1 offshore Falklands Sea Lion project

(OM) Rockhopper Exploration has commented on a progress report on the Sea Lion oil development in the offshore North Falkland basin from operator Navitas Petroleum LP. This includes an updated development plan, which takes into account static and dynamic reservoir models. Netherland Sewell & Associates’ latest independent report has increased gross 2C resources in the partners’ licenses in the basin... Continue Reading →

New cost estimation tool streamlines decision-making for oil & gas and offshore wind projects

FutureOn, a Norwegian software company specializing in the energy sector, has joined forces with Rystad Energy to launch a digital tool that integrates up-to-date cost estimation with live project data for energy developments, opening doors to accelerated project delivery and efficiency for companies across the energy supply chain. According to FutureOn, its FieldTwin and Rystad... Continue Reading →