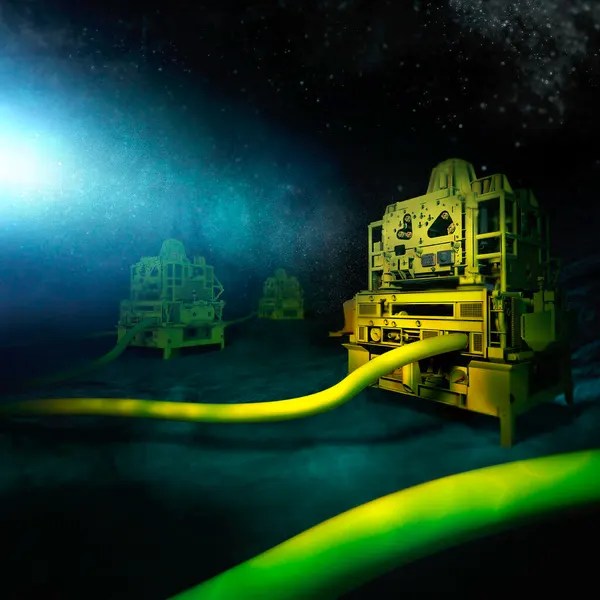

By Rafael Clemente, Key Sales Account Manager, Castrol Castrol explains why subsea hydraulic systems will be integral as we look for proven, viable solutions that are commercially feasible and do the job Operators today face an unenviable challenge: deploying new technology in more complex locations while increasing uptime and reliability at the same time. The... Continue Reading →

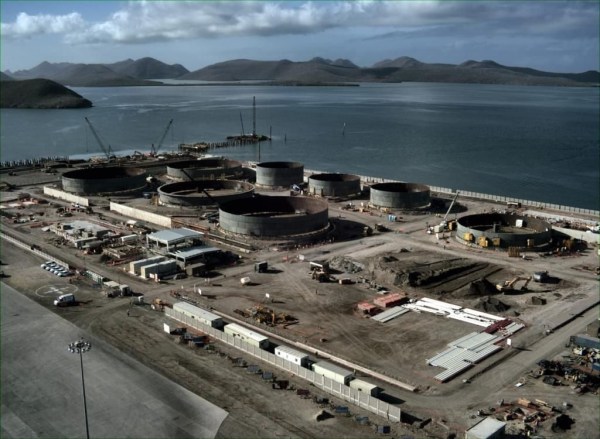

Petrobras announces investments in refining and petrochemicals in Rio de Janeiro

Petróleo Brasileiro S.A. – Petrobras announces that approximately R$33 billion in investments are planned for refining and petrochemical projects in Rio de Janeiro, of which R$29 billion in Petrobras Capex and R$4 billion in another project that operates in synergy with Petrobras assets. The implementation of the integration projects of the Boaventura Energy Complex (Itaboraí... Continue Reading →

Petrobras Targets Africa as Its Main Exploration Area Outside Brazil

(Reuters) Petrobras aims to make Africa its main region of development outside Brazil, the state-run oil giant's CEO told Reuters on Thursday during a wide-ranging interview about the company's strategy. Ivory Coast has extended the "red carpet" for Petrobras to explore deep and ultra-deep waters off its coast, when it gave the company preference in... Continue Reading →

Trelleborg market research reveals sizeable untapped operational value in FPSO hose operations

– Trelleborg Fluid Handling Solutions a global leader in the supply of field-proven large-bore flexible bonded hoses for crude oil and chemicals, has published a report that reveals significant opportunities for Floating Production Storage and Offloading (FPSO) owners to reevaluate their reeling hose selection and unlock greater operational value. Based on substantiative interviews with some of the leading... Continue Reading →

Petrobras Financial Performance in 1Q25

“The first quarter of 2025 was marked by positive results that reflect Petrobras' strong performance. We generated a higher cash flows, mainly due to a 5% increase in production volume compared to the previous quarter. This production growth was reflected in Adjusted EBITDA, which rose 46% compared to 4Q24.” Fernando Melgarejo, Chief Financial and Investor... Continue Reading →

Sempra to sell Mexico energy assets, stake in infrastructure unit

(Reuters) - Utility firm Sempra will sell some energy infrastructure assets in Mexico and a minority stake in Sempra Infrastructure to fund its five-year capex plan of $56 billion, it said on Monday. In February, the company had forecast a five-year capital plan of about $56 billion, a 16% increase from its prior plan, with over... Continue Reading →

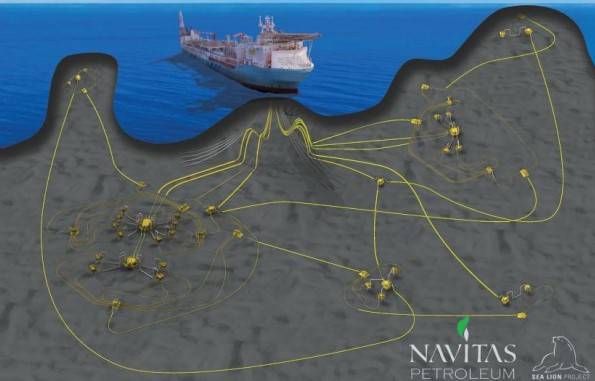

Sea Lion Offshore Oil Project in Falkland Islands Targets FID in Mid-2025

(OE) A final investment decision (FID) for the Sea Lion development offshore the Falkland Islands could be reached in mid-2025, according to Rockhopper, which is partner in the project with the operator Navitas Petroleum. Navitas continues to estimate Capex to first oil on phase 1 of c$1.4 billion and in this regard has entered into... Continue Reading →

PRIO 2025 Reserves Certification

PRIO S.A. ("Company" or "PRIO") hereby informs its shareholders and the general market that it has published a new reserves certification of the Company, prepared by DeGolyer & MacNaughton ("D&M"), dated January 1, 2025, which includes the reserves of the Polvo and TBMT cluster, Frade and Wahoo cluster and Albacora Leste field. To the Peregrino... Continue Reading →

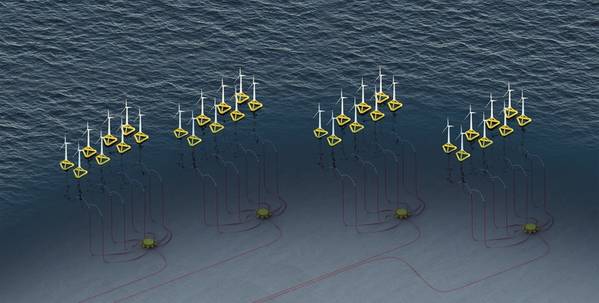

Subsea Redesign Underway for Floating Offshore Wind

Wendy Laursen, Contributing Writer (OE) The 66kV high voltage wet mate connector currently undergoing technical qualification by Baker Hughes weighs in at around one ton and has over 40 liters of dielectric oil protecting copper cable up to 1,200 square millimeters in diameter. The connector is designed to sit on the seabed at the end of... Continue Reading →

Guyana poised to add close to one million barrels per day as FPSO sector takes off globally

(oilnow.gy) A total of 56 FPSO projects, between 2022 and 2027, are expected to commence their operations worldwide. Brazil leads the list with 22 followed by Guyana, with three already in production and three more under construction. Norway-based energy research and business intelligence company Rystad Energy says the FPSO market witnessed a 50% increase in... Continue Reading →