(Reuters) - Vitol will buy stakes in West African oil and gas assets from Italy's Eni, bolstering the global commodity trading house's position in the upstream sector, as it seeks to reinvest the huge profits it has been generating since 2022. The commodity trader will acquire an interest in oil and gas producing assets and... Continue Reading →

Petrobras Eyes Argentina, Colombia, Africa Projects

(Reuters) Petrobras is looking at potential opportunities in Argentina while advancing in projects in Colombia and Africa, the firm's exploration and production head Sylvia dos Anjos said on Tuesday. Gas from the Vaca Muerta region would be interesting to Petrobras as a pipeline connecting Argentina, Bolivia and Brazil could be used to transport it, Anjos said on the... Continue Reading →

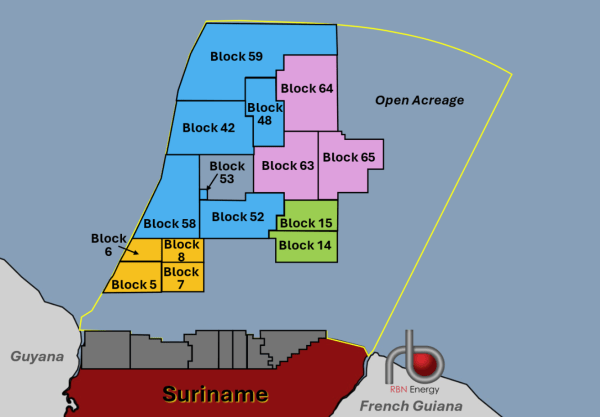

Suriname among top oil frontiers, 2.2 billion boe secured since 2020 – Rystad Energy

(oilnow.gy) Suriname is set for a wave of oil and gas exploration, with industry giants Shell, TotalEnergies, and Chevron leading efforts to tap into the country’s promising offshore reserves. Operators plan to drill around 10 wells between 2025 and 2027 in Suriname’s portion of the Guyana-Suriname Basin. A new report from Norway-based Rystad Energy said... Continue Reading →

Galp Makes Another Oil and Gas Discovery at Orange Basin Off Namibia

(OE) Galp, together with its partners NAMCOR and Custos, has hit oil and gas in another well drilled at PEL83 license at Orange Basin, offshore Namibia. The Joint Venture partners have drilled, cored and logged the Mopane-3X well (Well #5) which spud on January 2, 2025 as part of the second exploration and appraisal campaign... Continue Reading →

Agogo FPSO Set to Sail to Azule Energy’s Field Offshore Angola

(OE) The Agogo floating, production, storage and offloading (FPSO) unit is ready to set sail from Chinese shipyard to Azule Energy’s development offshore Angola. Yinson Production has officially named the Agogo FPSO at a grand naming and sail away ceremony held at Cosco Shipping Heavy Industry (Shanghai) shipyard in Shanghai, China. The vessel is now... Continue Reading →

Boost in oil reserves ahead of rig activity spotlights Angolan offshore block’s potential

(offshore-energy.biz) UK-headquartered and AIM-listed company Afentra has confirmed that hydrocarbon production from a block off the coast of Angola has been offset by a growth in reserves based on the latest Competent Person’s Report (CPR) for Block 3/05, conducted by ERC Equipoise (ERCE). Following its entrance into Angola in May 2023, the company disclosed a sale and purchase agreement (SPA)... Continue Reading →

Amplus Energy Services Buys Altera’s FPSO Fresh Off Duty from Brazil

(OE) Floating production solutions specialist Amplus Energy Services has signed an agreement with Altera Infrastructure to acquire the Petrojarl I floating production storage and offloading (FPSO) unit, which recently completed its deployment at Petrobras’ Atlanta field offshore Brazil. The acquisition marks Amplus' initial vessel ownership, positioning the company to expand this strategy and meet growing... Continue Reading →

Brazil’s Petrobras Looks to Africa for Oil Reserves Boost

(Reuters) Brazil's Petrobras wants to buy stakes in African oil assets, mainly in Angola, Namibia and South Africa, to boost its reserves as it expects output to fall after 2030, a senior executive said on Wednesday. The Brazilian state energy firm is in talks with companies, including existing partners ExxonMobi, Shell and TotalEnergies, to buy... Continue Reading →

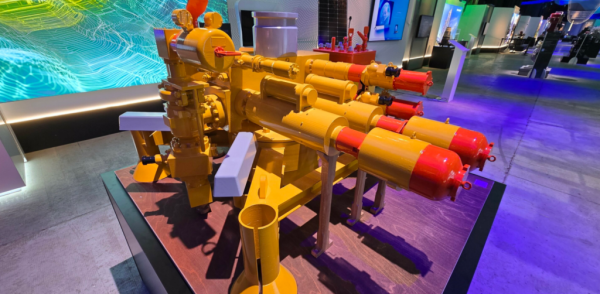

Baker Hughes rolls out all-electric subsea system to advance offshore electrification

(offshore-energy.biz) U.S.-headquartered energy technology giant Baker Hughes has launched an all-electric subsea production system, marking a step towards full electrification in offshore operations. According to Baker Hughes, the system delivers a fully electric topside-to-downhole solution, designed to integrate with existing subsea tree designs or retrofit electro-hydraulic trees. The move aims to slash costs, installation time,... Continue Reading →

Exxon beats Q4 estimates with higher Permian, Guyana output

(Reuters) Exxon Mobil on Friday beat Wall Street's estimate for fourth-quarter profit as higher oil and gas production offset lower oil prices and weaker refining margins. Fourth quarter profit was $7.39 billion. Profit per share was $1.67, beating analyst estimates of $1.56, according to LSEG data. The No. 1 U.S. oil producer reported total earnings of... Continue Reading →