Jan. 4 (OE) French offshore marine services company Bourbon has completed a financial and capital restructuring, with Davidson Kempner Capital Management LP and Fortress Investment Group becoming its majority shareholders. The restructuring marks the start of a new strategic phase aimed at improving profitability, enhancing organizational efficiency, and expanding market presence. Approved in July 2025... Continue Reading →

Chevron Delivers First Oil from New Platform Offshore Angola

Jan. 6 (OE) Chevron has delivered first oil from its South N’dola platform offshore Angola, marking a major project milestone just over two years after construction began. Located in Block 0, which accounts for around 12% of Angola’s daily energy output, the new platform connects to existing infrastructure via a tieback to the Mafumeira facility,... Continue Reading →

Subsea Vessel Market Outlook ‘Robust’ for 2026

Jesper Skjong, Contributor Dec. 20 (OE) Throughout 2025 we have seen the subsea vessel market transitioning from a period of record highs towards a more cautious, but still fundamentally strong, outlook. While short-term activity and rates have softened in the latter part of the year, long-term demand - driven by deepwater projects and global energy infrastructure-... Continue Reading →

SBM Offshore Nets Lease Extensions for Angola FPSOs with ExxonMobil Unit

Dec. 18 (OE) SBM Offshore has signed a contract extension related to the lease and operation of floating production, storage and offloading (FPSO) units Mondo and Saxi Batuque with ExxonMobil’s Angolan subsidiary. The extension secures ownership and operations by SBM Offshore until 2032 for the FPSOs in Block 15 offshore Angola, operated by Esso Exploration... Continue Reading →

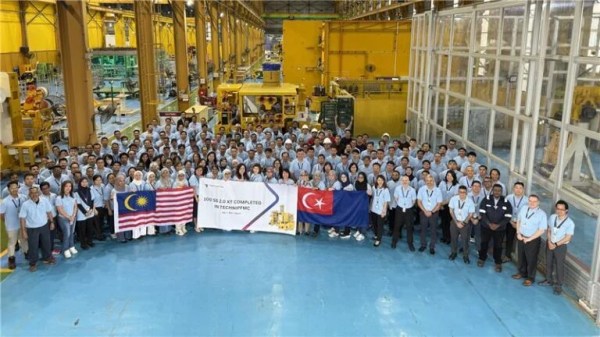

TechnipFMC’s 100th Subsea 2.0 tree goes to Shell, the platform’s first customer

Dec. 12 (offshore-energy.biz) TechnipFMC has delivered its 100th Subsea 2.0 tree to UK-headquartered energy giant Shell, the company that placed the first order for the subsea product platform. The subsea tree was manufactured, assembled, and tested at TechnipFMC’s dedicated facility for Subsea 2.0 in Nusajaya, Malaysia, and will be used on Shell’s project in the Gulf... Continue Reading →

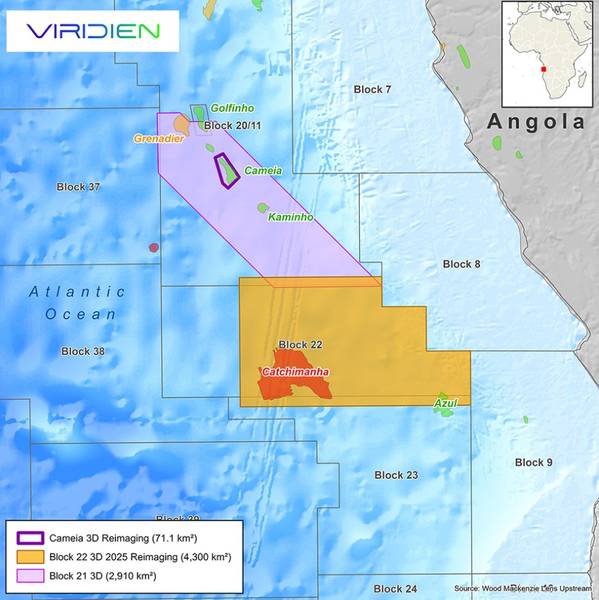

Angola licensing round boosted by Viridien’s seismic reimaging program

Dec.10 (splash247.com) Viridien, formerly CGG, has announced a new multi-client seismic reimaging program over Angola’s highly prospective offshore block 22 to support the country’s upcoming licensing round. The 4,300 sq km high-end data set will provide insight into underexplored structures along the Atlantic Hinge zone, following the same trend as the proven Cameia and Golfinho... Continue Reading →

Lukoil’s international assets and potential buyers

Dec 9 (Reuters) - Russia's Lukoil has until December 13 to negotiate the sale of the bulk of its international assets after the U.S. imposed sanctions on the company and rejected its initial buyer, Swiss commodity trader Gunvor. Lukoil's international assets, spanning upstream oil and gas projects, refining, and more than 2,000 filling stations across Europe, Central Asia, the Middle... Continue Reading →

TotalEnergies cements Namibia position with Galp asset swap

Dec 9 (Reuters) - TotalEnergies has cemented its position in offshore Namibia by agreeing to an asset swap with Portugal's Galp that makes the French company the operator of the major Mopane discovery, it said on Tuesday. In exchange for a 40% stake in the PEL83 licence holding the Mopane project, Galp will get a 10% interest... Continue Reading →

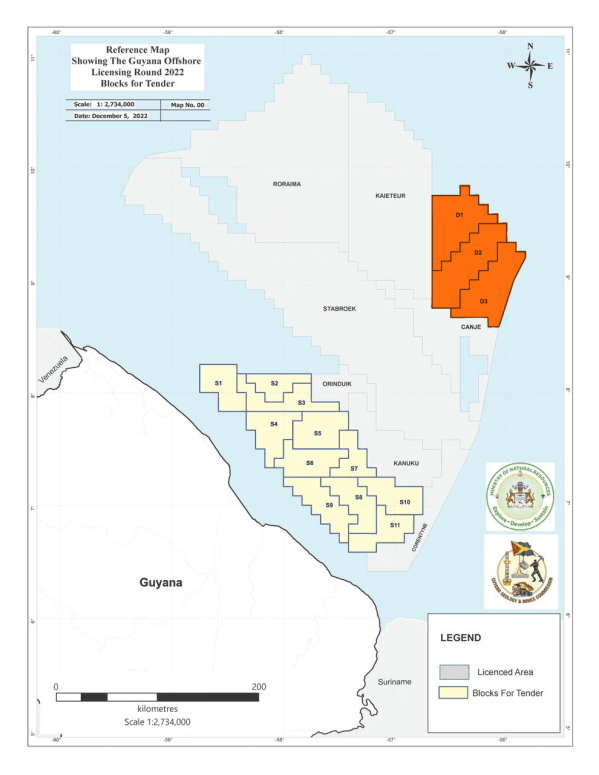

Ghanaian firm to ink deal for oil and gas search offshore Guyana

Dec. 9 (oilnow.gy) Ghana-based Cybele Energy Limited is set to sign a petroleum agreement on Tuesday, December 9, to explore for oil and gas offshore Guyana. This will be the second block awarded from the country’s first competitive offshore auction. The ceremony will take place at the Pegasus Suites and Corporate Center in Georgetown, where... Continue Reading →

Shell’s output hole is a reason to gulp down Galp

Dec 4 (Reuters Breakingviews) - Shell’s status as Big Oil’s safest pair of hands has its limits. The $212 billion UK major's dividend is relatively more secure against oil price slumps than peers, its net debt is a low 21% of total capital, and operating costs are over 10% less than two years ago. Yet Shell... Continue Reading →