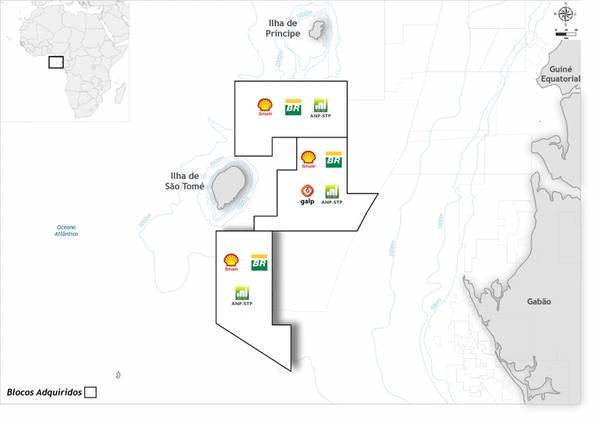

Oct. 7 (OE) Portugal’s Galp has reached a farm-in agreement with KE STP Company, a Shell affiliate, for the acquisition of a 27.5% stake in São Tomé and Príncipe’s Block 4, forming a joint venture with Shell, Petrobras and ANP-STP. With the agreement, Galp expands its presence offshore São Tomé and Príncipe, entering another early-stage... Continue Reading →

Exclusive: Batista brothers’ J&F in talks for EDF plant as Brazil power M&A surges

Oct 3 (Reuters) - J&F Investimentos SA, the holding company owned by Brazil's billionaire Batista brothers, is in talks to acquire French utility EDF's Rio de Janeiro thermal plant, according to two people familiar with the matter. The deal, which could fetch up to 2 billion reais ($374 million) according to one of the sources,... Continue Reading →

Brava Energia on closing of the purchase and sale transaction of gas midstream infrastructure with Petroreconcavo

BRAVA ENERGIA S.A. (“BRAVA” or “Company”) (B3: BRAV3), pursuant to CVM Resolution No. 44, and following the Material Fact disclosed on May 5, 2025, informs its investors and the market in general that the Asset Purchase and Sale transaction (“Agreement”) with PETRORECONCAVO S.A. (“PetroReconcavo”), regarding the sale of 50% of the gas midstream infrastructure in... Continue Reading →

TotalEnergies launches savings plan, cuts capex after rising debt worries investors

Sept 29 (Reuters) - TotalEnergies will cut its annual capital expenditure by $1 billion, it said on Monday, as the French oil major sought to soothe investor fears over slow asset sales and rising debt at a meeting with investors in New York. The reduction in capex, to around $15–17 billion annually between 2027 and 2030,... Continue Reading →

Chevron expects up to $400 million quarterly impact from Hess deal

Sept 25 (Reuters) - U.S. energy major Chevron said on Thursday it was expecting to take a hit of $200 million to $400 million in the third quarter related to the Hess deal. Chevron closed its $55 billion acquisition of Hess in July after winning a landmark legal battle against larger rival Exxon Mobil to gain access to the... Continue Reading →

ANP Expects R$17Billion in Investments from the Extension of Round Zero Onshore Contracts

The Brazilian oil and gas sector is expected to receive approximately R$17 billion in new onshore investments from the extension of contracts for 139 onshore oil and natural gas production fields originated in Round Zero. This figure was released by the National Petroleum Agency (ANP). The so-called Round Zero was held in 1998, following the... Continue Reading →

Perenco Launches Reactivation Program for Two Mothballed Campos Basin Fields

Sept. 16 (OE) Perenco has started active field reactivation program for the Cherne and Bagre fields in Campos Basin, acquired from Petrobras earlier in 2025, helping meet the industry’s mature field challenges and unlocking in excess of 50 mmstb of reserves. The multi-dimensional, two-year, reactivation program was designed to be executed in three linked stages... Continue Reading →

Petrobras announces participation in exploratory block in São Tomé and Príncipe

Sept. 13 - Petrobras informs that it has concluded the acquisition of a 27.5% stake in Block 4, located in São Tomé and Príncipe, Africa. With this acquisition, Petrobras joins the consortium of the aforementioned block, which includes Shell, the operator of the asset (30%), as well as Galp (27.5%) and ANP-STP (15%). Petrobras has... Continue Reading →

Carlyle to buy Altera Infrastructure’s FPSO Business

Sept. 2 (OE) Altera Infrastructure has entered into an agreement to sell its entire floating production, storage and offloading (FPSO) business to global investment firm Carlyle. The acquired business includes Altera’s full FPSO portfolio, the floating storage and offloading (FSO) unit Yamoussoukro and the 50% ownership in the joint venture Altera&Ocyan. The portfolio includes the... Continue Reading →

Petrobras open to IG4 plan to take control of Braskem, sources say

Aug 29 (Reuters) - Brazil's state-run oil firm Petrobras has been receptive to a proposal by IG4 Capital to take over engineering group Novonor's controlling stake in Latin America's largest petrochemical company, Braskem, four people familiar with the talks told Reuters. Petrobras, Braskem's second-largest shareholder, holds a right of first refusal for Novonor's stake under... Continue Reading →