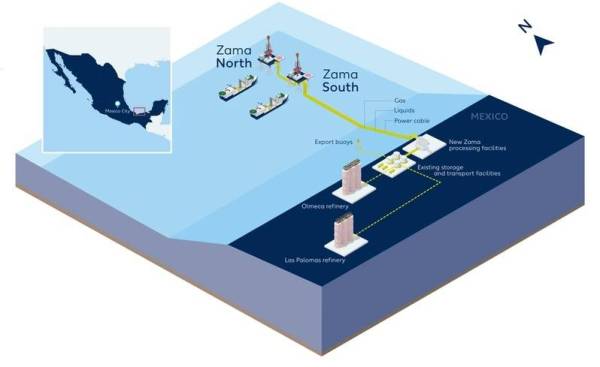

Dec. 31 (OE) U.K.-based oil and gas firm Harbour Energy has been appointed operator of the Zama oil project offshore Mexico. The appointment was agreed by the Zama partners, including Pemex, Grupo Carso and Talos Energy who will have the option to appoint key personnel into Harbour's project team, and subsequently approved by SENER (Mexico's... Continue Reading →

Saipem Extends Charter, Purchase Option for Deep Value Driller Drillship

Dec. 29 (OE) Deep Value Driller has agreed with Saipem to extend the bareboat charter for its seventh-generation drillship Deep Value Driller and to prolong the period during which Saipem may exercise an option to buy the vessel. Under the amended agreement, the parties have agreed to a firm 31-day extension of the charter through... Continue Reading →

BP Sells Majority Stake in Castrol to Stonepeak for $6B

Dec. 24 (OE) BP has agreed to sell a 65% stake in its Castrol lubricants business to infrastructure investor Stonepeak at an enterprise value of about $10 billion, as the energy major presses ahead with its divestment program and balance sheet repair. The transaction is expected to generate net proceeds of around $6 billion for... Continue Reading →

Petrobras announces update on Braskem

Dec. 23 - Petrobras, following up on the announcement dated December 15, 2025, informs that, in light of the progress in negotiations related to Braskem and in order to expedite the necessary authorization procedures, Shine I Fundo de Investimento em Direitos Creditórios de Responsabilidade Limitada (FIDC) submitted today the potential transaction to Brazil’s Administrative Council for Economic Defense (CADE), with... Continue Reading →

Orsted sells 55% of Taiwan wind farm to Cathay

Dec 23 (Reuters) - Danish offshore wind developer Orsted has agreed to sell a 55% stake in its Greater Changhua 2 offshore wind farm in Taiwan to life insurance company Cathay in a deal worth around 5 billion Danish crowns ($788.74 million), it said on Tuesday. Orsted, the world's largest offshore wind developer, is trying... Continue Reading →

Petrobras informs about Braskem

December 15, 2025 – Petróleo Brasileiro S.A. - Petrobras informs that it has been notified by Novonor S.A. – Em Recuperação Judicial (“Novonor”) and NSP Investimentos S.A. (“NSP Inv.”), a subsidiary of Novonor, regarding the execution of an “Exclusivity Agreement with Shine I Fundo de Investimento em Direitos Creditórios de Responsabilidade Limitada (‘FIDC’), a credit... Continue Reading →

Brazil’s Braskem set for control shake-up as Novonor sells stake to IG4

Dec 15 (Reuters) - Brazilian petrochemical producer Braskem said on Monday that conglomerate Novonor has signed an agreement to sell its controlling stake in the company to private equity firm IG4 Capital. Under the deal, IG4 will share control of Braskem with state-run oil giant Petrobras , the company's second-largest investor. Novonor is set to retain... Continue Reading →

Shell Seeks Buyer for 20% Stake in Brazilian Oilfield Cluster

Dec. 9 (Reuters) Shell is seeking a buyer for a 20% stake in its Brazilian oilfield cluster to help fund a multibillion-dollar offshore development, Bloomberg News reported on Tuesday, citing sources. Shell declined to comment on the report, when contacted by Reuters. Shell held a 50% stake in Gato do Mato, which is a deepwater project offshore Brazil, and... Continue Reading →

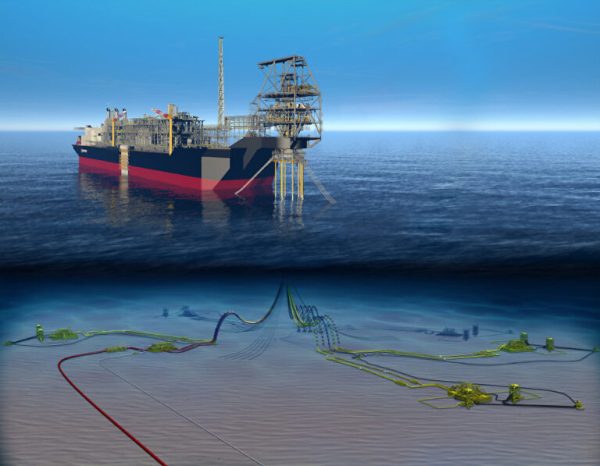

Prio is studying the interconnection of the FPSOs Peregrino and Tubarão Martelo

Dec. 9 - Prio is studying the interconnection of the FPSOs of the Peregrino and Tubarão Martelo fields, leveraging the proximity and successful experience of previous interconnections in the Polvo/Tubarão Martelo cluster (Project Phoenix), to optimize costs, increase efficiency and maximize oil recovery, a strategic move following the acquisition of Peregrino from Equinor. Strategy Details:Opportunity:... Continue Reading →

Shell’s output hole is a reason to gulp down Galp

Dec 4 (Reuters Breakingviews) - Shell’s status as Big Oil’s safest pair of hands has its limits. The $212 billion UK major's dividend is relatively more secure against oil price slumps than peers, its net debt is a low 21% of total capital, and operating costs are over 10% less than two years ago. Yet Shell... Continue Reading →