Jan. 29 (oilprice.com) Russia’s oil producer Lukoil has agreed to sell most of its international assets to private equity giant Carlyle. Following the U.S. sanctions on Lukoil and Rosneft, “as a result of Russia’s lack of serious commitment to a peace process to end the war in Ukraine,” Lukoil announced in October it would sell all of its international assets, initiating a... Continue Reading →

SLB tops quarterly profit estimate, plans $4 billion shareholder returns

Jan 23 (Reuters) - SLB beat Wall Street estimates for fourth-quarter profit on Friday, as the world's top oilfield services provider benefited from the ChampionX acquisition and unveiled plans to return $4 billion to shareholders this year. The company closed the $7.75 billion all-stock acquisition of ChampionX last July, adding production chemicals and artificial lift technologies... Continue Reading →

Brazil’s Petrobras to buy five gas tankers, multiple vessels for $521 million

Jan 20 (Reuters) - Brazilian state-run oil firm Petrobras and its logistics subsidiary Transpetro on Tuesday signed contracts with shipyards for five gas carriers, 18 barges and 18 pushers, for 2.8 billion reais ($521 million). The companies made the deal official at an event in Brazil's southern Rio Grande do Sul state. Brazilian President Luiz Inacio... Continue Reading →

With refining spin off, Galp focuses on growing upstream in Brazil, Namibia

Jan 20 (Reuters) - Portuguese energy firm Galp will focus on growing its upstream business from oilfields in Brazil and Namibia and may list parts of its newly formed downstream business in a couple of years, its co-chief executive Joao Diogo Marques da Silva told Reuters on Tuesday. The company said earlier this month it was in... Continue Reading →

Maha Capital seeks US approval to buy stake in Venezuelan oil firm

Jan 19 (Reuters) - Swedish investment platform Maha Capital is seeking approval from the United States to acquire an indirect minority stake in a PDVSA-controlled oil firm, Maha's chairman of the board, Paulo Thiago Mendonca, told Reuters on Friday. The firm has until May to exercise an option for a majority stake in a Novonor subsidiary... Continue Reading →

Grupo Carso Buys Out Lukoil Offshore Oil Fields in Mexico

Jan 19 (Reuters) Mexican conglomerate Grupo Carso, controlled by magnate Carlos Slim, will buy out Lukoil to hold a full stake in the Ichalkil and Pokoch offshore oil fields, the firm said in a filing on Monday. In the deal, Grupo Carso will buy Lukoil subsidiary Fieldwood Mexico for $270 million, along with paying off $330 million of... Continue Reading →

JERA Nex BP to buy EnBW’s stake in UK’s Mona offshore wind project

Jan 16 (Reuters) - JERA Nex BP will buy its partner EnBW's stake in the Mona offshore wind project and has signed a lease agreement for the British facility, it said on Friday. The move comes a day after German utility EnBW said it would take a 1.2 billion euro ($1.39 billion) impairment charge after pulling out of... Continue Reading →

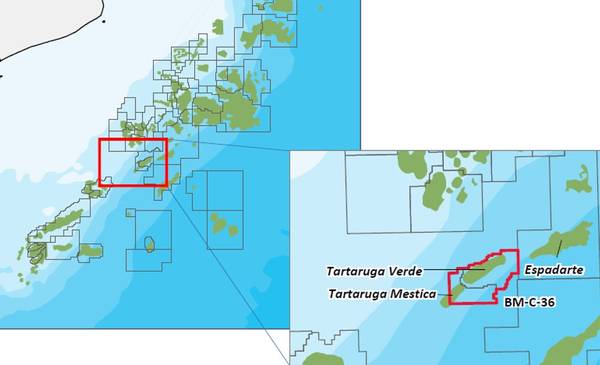

Brava Energia signing of acquisition of interesst in Tartaruga Verde nd Espadarte – Module III

Jan. 16 - BRAVA ENERGIA S.A. (“Brava” or “Company”) (B3: BRAV3), pursuant to CVM Resolution No. 44, hereby informs its investors and the market in general that, on January 15, 2026, it has entered into an agreement for the acquisition of the entire 50% equity interest currently held by PETRONAS Petróleo Brasil Ltda. (“PPBL”) in... Continue Reading →

Swiss Company Buys Minority Stake in BW Ideol

Jan 7 (offshoreWIND.biz) Switzerland-headquartered Holcim has taken a minority equity ownership in the floating offshore wind technology developer BW Ideol. “This investment sends a powerful message to the floating offshore wind industry, confirming the maturity and deliverability of concrete foundation solutions. With Holcim by our side, we’re making significant strides in our large-scale, concrete serial... Continue Reading →

Peru opens state-owned Petroperu to private investment after reorganization

Jan. 2 (Reuters) - Peru issued an emergency decree late Wednesday approving the reorganization of state-owned oil firm Petroperu, allowing private investment in key company assets. The decree signed by Peru's President José Jerí says the company could be separated into one or more asset blocks, including the state-of-the-art Talara refinery that the company spent... Continue Reading →