Feb. 17 (OE) Saipem has reached agreement on the main terms and conditions to acquire the seventh-generation drillship Deep Value Driller for $272.5 million. The Deep Value Driller is a high-specification ultra-deepwater drillship built in 2014, featuring GustoMSC P10000 design and able to accommodate 210 people. The drillship is capable of operating in water depths... Continue Reading →

Petrobras informs about Braskem

February 12, 2026 – Petróleo Brasileiro S.A. - Petrobras, further to the release disclosed on December 15, 2025, informs that, at a meeting held on February 11, 2026, its Board of Directors, considering a potential transaction (“Transaction”) involving the transfer of shares of Braskem S.A. held by NSP Investimentos S.A., a subsidiary of Novonor, to... Continue Reading →

Shell needs big discovery or deals as oil, gas reserves dwindle

Feb 9 (Reuters) - Shell needs an acquisition or exploration breakthrough to make up for an expected production shortage of 350,000-800,000 barrels of oil equivalent per day by 2035 due to maturing fields unable to meet its output targets, the company and analysts say. For years, oil majors have been restrained in topping up reserves,... Continue Reading →

Transocean to Acquire Valaris for $5.8B

Feb. 9 (Reuters) Oilfield services firm Transocean said on Monday it will acquire peer Valaris in an all-stock deal valued at $5.8 billion, expanding its exposure across deepwater, harsh-environment and shallow-water basins worldwide. Transocean shares were down 4% at $5.16, while Valaris shares were up 14.6% at $71.61 in premarket trade. Oilfield service providers have... Continue Reading →

Namibia won’t recognise TotalEnergies, Petrobras deal due to not following procedure

Feb 8 (Reuters) - Namibia will not recognise the purchase of offshore stakes in the Luderitz Basin announced last week by TotalEnergies and Petrobras until the oil companies follow the proper route for approval, government officials said on Sunday. Jonas Mbambo, a spokesperson for the presidency, confirmed that until a formal application is submitted and the prescribed... Continue Reading →

BW Energy’s Planned Angola Entry Challenged by Pre-Emption Rights

Feb. 6 (OE) BW Energy has informed that one of the existing joint venture partners in Angola's offshore blocks 14 and 14K has indicated its intention to exercise pre-emption rights in relation to the previously announced acquisition agreement. BW Energy and its partner Maurel & Prom had been notified of the move by a joint... Continue Reading →

Petrobras acquires stake in exploration block in the Republic of Namibia.

February 6, 2026 – Petróleo Brasileiro S.A. – Petrobras announces that it has acquired a 42.5% stake in Block 2613, located offshore in the Republic of Namibia, Africa. The transaction was carried out in partnership with TotalEnergies, which also acquired 42.5% and will act as the operator of the block. The selling companies are Eight Offshore... Continue Reading →

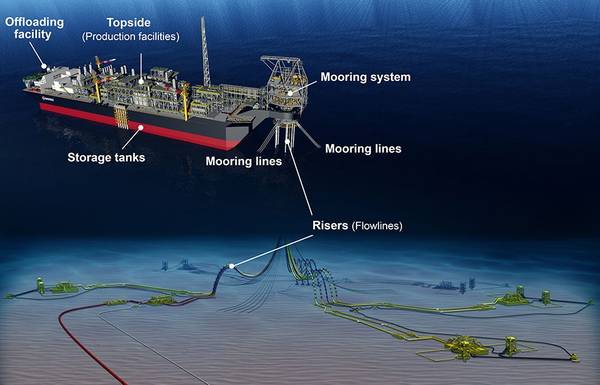

FPSO ONE GUYANA Purchase by ExxonMobil Guyana Completed

Feb. 4 - SBM Offshore and ExxonMobil Guyana Ltd, an affiliate of Exxon Mobil Corporation, have completed the transaction related to the purchase of FPSO ONE GUYANA, ahead of the maximum lease term which would have expired in August 2027. The purchase allows ExxonMobil Guyana to assume ownership of the unit while SBM Offshore will continue to... Continue Reading →

Shell Welcomes KUFPEC as Partner in the Orca Project (Gato do Mato) in Brazil

Feb. 3 (TN) Shell Brasil Petróleo Ltda. (Shell Brasil), a subsidiary of Shell plc, has signed an agreement to sell a 20% stake in the Orca Project to Kuwait Foreign Petroleum Exploration Company (KUFPEC). Orca is a deepwater project in the pre-salt area of the Santos Basin. After the transaction is completed, Shell will remain... Continue Reading →

Equinor divests parts of its Argentina assets in $1.1 billion deal

Feb 2 (Reuters) - Norway's Equinor said on Monday it has agreed to sell its onshore business in Argentina's Vaca Muerta basin to Vista Energy for $1.1 billion, half paid in cash and the other half in the form of Vista shares and future payments linked to output and oil prices. "The consideration includes contingent... Continue Reading →