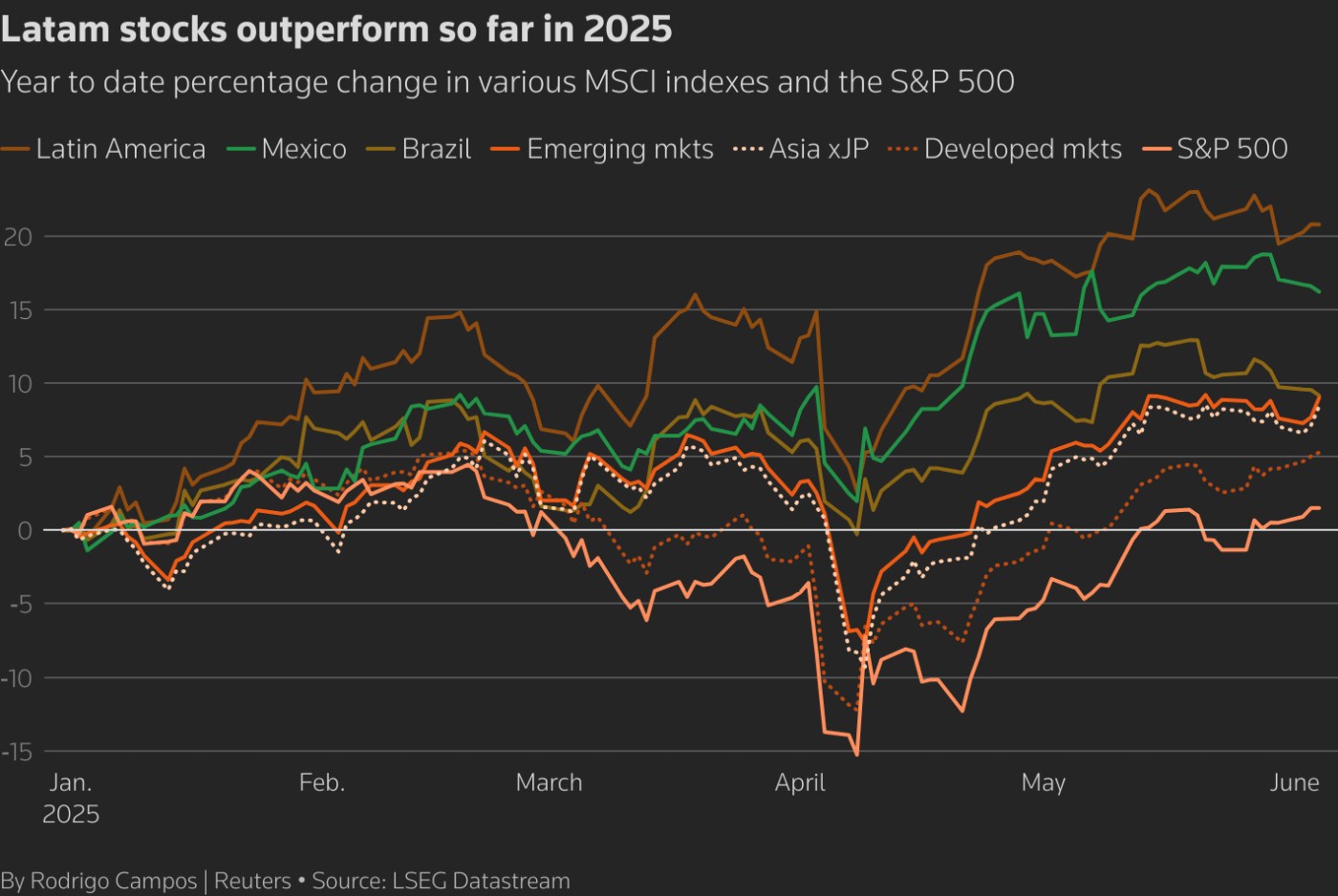

(Reuters) – Latin America has emerged as a top investing destination as ongoing wars – both of the military and trade variety – make investors seek options in a region they view as refreshingly untroubled by tariffs and major conflicts.

Portfolio flows data suggests that investors are largely underexposed to Latin America even as many stock markets – including Brazil’s and Mexico’s – are trading at or near record highs, while sovereign bonds offer still-attractive yields. Although some prefer not to chase a stock rally, others have focused on the local debt markets.

“The Latam story is easier to tell now as stocks are cheap and there is a lack of options in emerging markets,” said Leonard Linnet, head of equities at Itau BBA. “China is at the epicenter of the trade war, India is more expensive and has some geopolitical issues with Pakistan and investors are avoiding investing in Russia.”

Brazil and Mexico are the behemoths where most international investors concentrate their exposure to Latin America. Both carry by far the largest regional weights in global benchmarks for stocks and bonds. Among all emerging markets, however, the two countries are relatively small. Brazil, which is Latin America’s largest economy and market, constitutes 60% of the MSCI Latam index and just below 5% of the broader EM index.

Read full article: https://www.reuters.com/business/investors-eye-latin-america-they-diversify-away-wall-street-2025-06-09/

Leave a comment