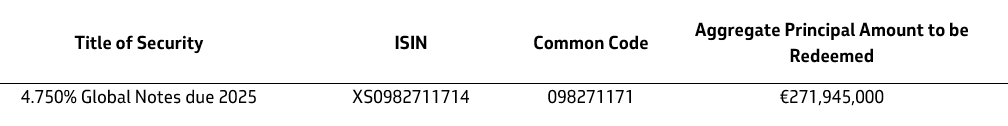

Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) announces that its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”) has delivered notices of redemption to the holders of the outstanding 4.750% Global Notes due 2025 (the “Notes”).

The redemption date for the Notes will be July 29, 2024 (“Redemption Date”).

The redemption price for the Notes will be the greater of (A) 100% of the principal amount of such Notes and (B) the sum of the present values of the remaining scheduled payments of principal and interest thereon (exclusive of interest accrued to the Redemption Date) discounted to the Redemption Date on an annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Bund Rate plus 40 basis points (the “Euro Make-Whole Amount”), plus in the case of each of clauses (A) and (B) above, accrued interest on the principal amount of such Notes from January 14, 2024 to (but not including) the Redemption Date. The Euro Make-Whole Amount will be determined and communicated to holders of the Notes on the third Business Day preceding the Redemption Date.

Payment on the Notes will be made prior to 12:00 pm London time on the business day preceding the Redemption Date by credit to the account of The Bank of New York Mellon, the trustee for the Notes (the “Trustee”), as paying agent for the Notes. The Trustee will cause funds to be paid to The Bank of New York Mellon, London Branch, as common depositary for Clearstream and Euroclear, for further payment to its participants.

On the Redemption Date, the Euro Make-Whole Amount, plus accrued interest, will become due and payable. Interest on the Notes will cease to accrue on and after the Redemption Date. Upon the redemption, the Notes will cease to be listed on the Luxembourg Stock Exchange, and the Notes and the related guarantees by Petrobras will be cancelled and any obligation thereunder extinguished.

PGF intends to fund the amounts necessary to redeem the Notes with available cash on hand.

For more information or if you have any questions regarding the redemption, please contact the Company’s investor relations department at petroinvest@petrobras.com.br

Leave a comment