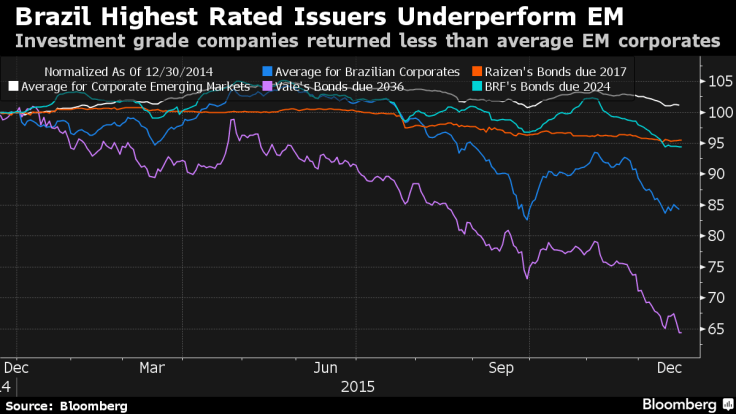

Brazil’s dwindling number of investment-grade companies is poised to shrink again in 2016.

After two downgrades to junk for sovereign debt and more than 200 corporate rating cuts in 2015, Latin America’s largest economy is now home to just 14 investment-grade companies. Six of those at the lowest investment grade have negative outlooks on their ratings, signaling the ranks of non-junk borrowers may soon shrivel to single digits.

The issuers enjoying the top grades are mostly companies that get a majority of their revenue from abroad, insulating them from Brazil’s deepest recession in 25 years and political turmoil that’s hampering President Dilma Rousseff’s efforts to shore up the budget. The new entrants to the junk category are likely to be companies more dependent on the domestic economy, such as builder Odebrecht Engenharia e Construcao SA and petrochemical company Braskem SA, which both are ranked at the lowest level of investment grade with a negative outlook by both Fitch Ratings and Standard & Poor’s.

Leave a comment